If you’re in search of a home loan or looking to refinance your current home loan, then no doubt you’re shopping for the best and lowest interest rate. While a lender or a broker may appear to be offering the lowest rate, the actual rate you should be concerned about is the APR.

If you’re going to shop based on interest rates, then the actual comparison you should be done based on the APR (Annual Percentage Rate)

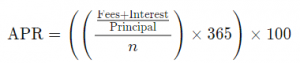

How is the Mortgage APR Calculated?

APR is calculated in three steps:

- Add all applicable fees to the loan amount.

- At the loan’s interest rate, figure what the monthly payment would be if you include fees in the loan amount rather than pay them upfront.

- Convert that “would-be” payment into an interest rate.

The result is the annual percentage rate.

What is the formula to calculate the Mortgage APR rate?

where:

- Interest = Total interest paid over the life of the loan

- Principal = Loan amount

- n = Number of days in loan term

In order to protect consumers from misleading advertising the APR formula provides a consistent way of representing the costs and fees associated with loan

Here’s an example:

You get a $400,000 mortgage with an interest rate of 3%, and you pay 1% origination fees to the lender, and your title and other fees totals $3,000 in upfront fees. So the total fees associated with the loan is $7,000

The monthly principal and interest payments are $1,686.42. But if you added the costs to the loan amount, the monthly principal and interest would be $1,715.93.

When you convert that “would-be” payment into a monthly and then annual rate, it comes out to 3.14%. The loan has an APR of 3.14%.

APR is a tool for comparing mortgage offers between different lenders and broker. There is a limitation to the APR calculation: The APR calculation assumes that the borrower will retain the loan for the entire duration.

For a 30-year loan, the entire term is 30 years. Very few people will stay in their home and keep their mortgages for the entire term of the loan.

Most homeowners will sell their home or refinance the mortgage before term every expires.